Prioritizing an Integrated Strategy

The Key to Long-Term Growth and Resilience

The role of financial institutions has progressed, with shifts in consumer perceptions, preferences, and behaviors driving changes to products, services, and delivery channels. To effectively respond to these changes, institutions must adapt by implementing a strategic and cohesive approach that integrates various departments and initiatives in technology, online presence, branding, marketing, and facilities planning. Non-alignment across these areas will hinder progress and impede the achievement of organizational goals. By integrating these key components, a clear roadmap for success can be established through network optimization and the coordination of online and in-person consumer experiences. This alignment is critical for sustained growth and competitiveness in the market.

Financial institutions (FIs) typically develop three-to-five-year strategic plans that form the basis for their annual tactical initiatives. These plans set objectives for various efforts aimed at promoting institutional growth, improving consumer retention, and increasing organizational efficiency and effectiveness. It is crucial for these strategic goals to filter throughout the entire organization, ensuring that activities and investments are aligned to achieve the desired outcomes. While marketing is crucial in attracting and engaging both existing and potential consumers to drive these retail goals, however, integration with retail facilities, roles, and function is also a key component that is frequently overlooked. Consequently, facilities are often left out of strategic planning discussions, viewed as a cost center rather than a strategic asset and program delivery channel.

Integrated Planning

An integrated Strategic Facility Plan guided by the overarching strategic objectives, works in close partnership with the retail strategy to ensure consistency and synergy. Furthermore, it harmonizes efforts across marketing, branding, and online initiatives to deliver a seamless and cohesive experience for consumers, prospects, and the community. Key components of a strategic facility plan include a thorough evaluation of existing branches across multiple dimensions. This evaluation starts with financial analysis including a comparison of branch performance versus the competition and projecting deposit and loan potential. It also includes the assessment of branding, operational flow, and technological infrastructure within each branch. Additionally, it involves inspecting the physical facilities, gathering feedback through surveys from both consumers and staff, and analyzing transactional data alongside demographic and lifestyle information of current consumers and existing market conditions. These components are essential for crafting a robust strategic facility plan that aligns with the institution’s objectives and enhances the overall branch experience for consumers and staff.

Plan to Grow

When planning for growth, it is crucial to include an assessment of expansion opportunities in your strategic facility plan. This analysis should consider demographics, traffic patterns, growth projections, and the financial strength of the target market as well as competition. It is also important to understand the specific niche(s) that your institution currently serves and identify areas where you can cater to that market effectively. Emphasizing density by creating clusters of branches, micro-branches, ITMs, and LPOs can create a market advantage. Additionally, planned development should be integrated with the existing facilities and locations to establish priorities, budgets, and schedules based on the opportunities presented.

Optimize the Network

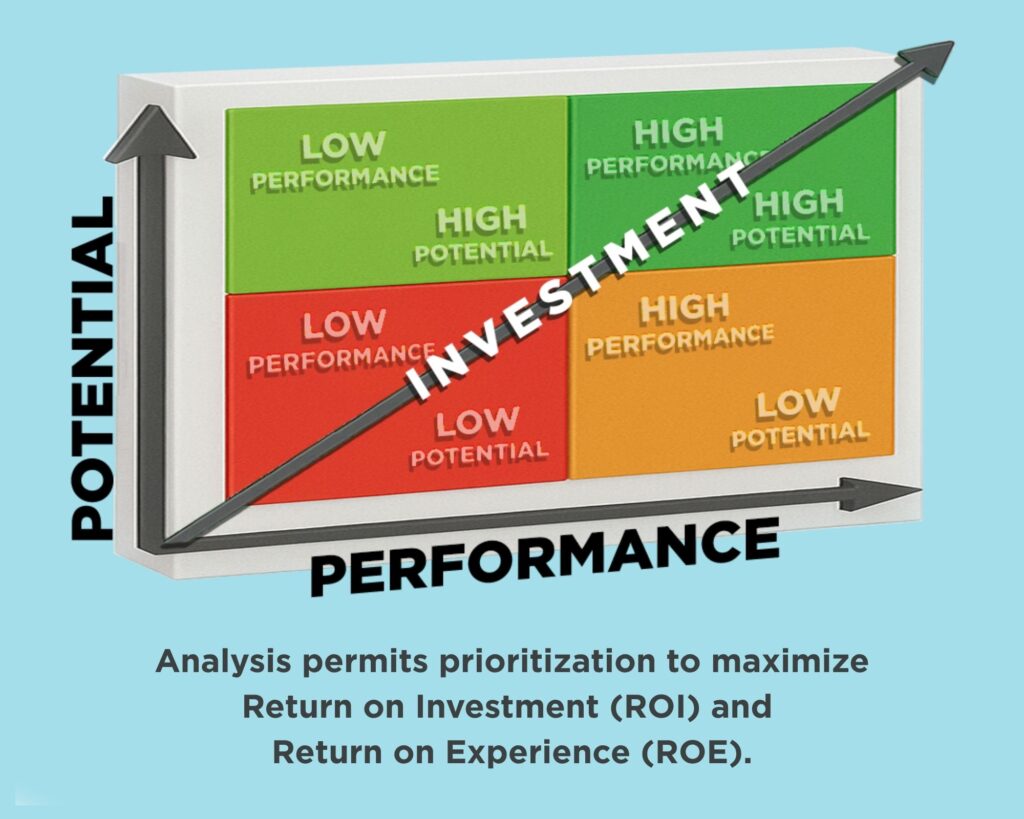

Optimization planning plays a crucial role in determining priorities and necessary initiatives for improving your branch network, and it is an integral component of your strategic facility plan. Optimization involves thorough analysis to document and communicate all enhancements to the existing network, potential expansion opportunities, consolidation strategies, and closure plans. The prioritization of projects is determined by aligning them with the strategic plan, goals, available opportunities, and budgetary constraints. A final roadmap is developed, outlining the scheduling of initiatives and projects in quarterly increments over the span of the plan, typically 3-to-5 years. This approach ensures that budget and resource realities are considered, allowing for the efficient staging of projects to meet organizational objectives effectively.

To ensure success, it is essential to conduct quarterly reviews of the plan to stay on track and make necessary adjustments. Post-activity surveys involving consumers and staff are conducted to monitor changes in brand and institutional perceptions, serving as benchmarks for improvement. Reporting on financial results and perceptions is crucial for building ROI and ROE (return on experience).

“Key components of a strategic facility plan include the assessment of branding, operational flow, and technological infrastructure within each branch.”

Change Means Opportunity

The changing banking environment demands a proactive and holistic approach to meet the varying needs and expectations of consumers. By aligning technology, online presence, branding, marketing, and facilities planning, financial institutions can navigate the shifting dynamics of the industry and position themselves for long-term success. Embracing this integrated strategy will not only drive growth and competitiveness but also foster meaningful relationships, ultimately shaping a more resilient and consumer-centric banking environment

Let’s Discuss Your Strategy First

We can help you integrate your facility plan with your strategic and retail banking plans. Let’s meet to discuss your situation and your goals for growth and retention.

Contact us to discuss your goals.