By Jim Caliendo, President & CEO, PWCampbell

There is so much to think about with banks these days, especially when it comes to the retail branch office. With generational shifts in trends and services offered, it begs a number of questions: Do we relocate branches? Do we make them smaller? Do we reimagine them, or do away with them all-together? It can be a stressful conundrum, but how does one go about finding the right answer?

One tried-and-true method has always been to perform a detailed optimization study on your retail branch network. An optimization study is a comprehensive look at each of your locations with respect to four main areas – the market, competition, branch financial performance, and the actual branch itself including the entire site and building. Only after a true deep dive into these areas can we even begin to make recommendations and set priorities, leading the way to the formation of a solid strategic plan for the entire network.

The first area that should be addressed is the market around each branch location. The make-up of the market can vary substantially from branch to branch and therefore, product offerings, marketing messages, and even retail space needs to reflect those nuances between markets. Studying the market will giveway to a world of valuable information, such as whether your area is growing or diminishing, the educational attainment, the socio-economic details of the area, and even area psychographics – all of which can indicate to marketing preferences and consumer behaviors. If you have a commercial product offering, a snapshot of the commercial market specifying the types of businesses and number of employees should also be examined.

Once you address your market, analyze your competition. You need to know who the key market players are, where they’re located, and how their product offering compares to yours. It’s also important to know their market share so you can see how you stack up against them. Determine if those key competitors continue to grow over the years, or are they losing deposits? Also identify any new players that have entered the market, paying special attention to any mergers and acquisitions that may have affected the playing field.

By now, your research is beginning to paint a picture, and a clear definitive answer is starting to take shape through the fog; but we are not done yet. Now is the time to look in the mirror and review the actual operations of the branch. When analyzing how the branch is financially performing, there are many factors to take into consideration. Key data points for each branch location should include deposit and loan balances, three-year monthly transaction volumes, deposit market share, current book value, income, expenses, staffing levels, and data concerning profit or loss. While some of this information may be hard to come by, the extra effort in detailing how the branch is performing will be essential to completing the overall strategic plan.

The last step in the optimization study is to perform an evaluation of the physical branch itself. While many institutions start and end here, the three prior steps are essential in forming the total picture and can aid tremendously in setting priorities. When looking at the branch, it is necessary to consider the site, the building, and the interior retail space. By carefully reviewing all three, you can gain an accurate sense of the overall quality of the branch. Ask yourself the following: Is the branch in a good location with ideal visibility, access to high traffic patterns, sufficient signage, and space that allows for parking and ancillary services such as ATMs and drive-up lanes? Is the building in good shape, can it support the company’s growth plans, and does it reflect consistency in the corporate brand? Do you know what major repairs or replacements, such as HVAC, will be needed in the next five years? Have you updated interior retail space to incorporate consistent company branding, introduce technology, and provide a modern environment that mirrors the needs and wants of your customer base? Is your branch set up to be a dynamic marketing tool through merchandising? These are all important factors in getting to the root of the answer.

Finally, the dust has settled, and a clear picture has emerged from the ashes. With the optimization study complete, you can now begin to form and prioritize knowledgeable recommendations for maximizing efficiencies, marketability, appearance, and growth potential for your institution’s overall footprint.

Finally, the dust has settled, and a clear picture has emerged from the ashes. With the optimization study complete, you can now begin to form and prioritize knowledgeable recommendations for maximizing efficiencies, marketability, appearance, and growth potential for your institution’s overall footprint.

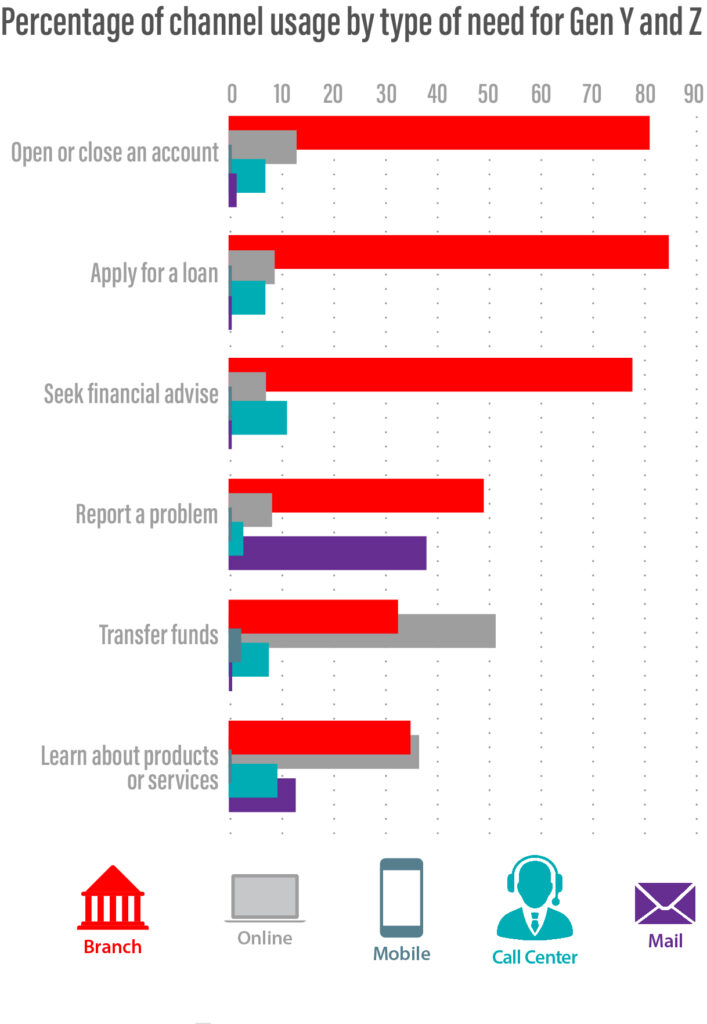

While the physical make-up of the branch is up for debate, one fact remains: People are still visiting bank branches. According to research conducted by Novantas, 60% of Americans said they would rather open a new checking account in person at a bank branch than on a phone, tablet, or desktop computer. This is further reinforced with the reality that most consumers still only use digital channels for the most basic banking functions, such as checking account balances and transferring funds, yet overwhelmingly prefer face-to-face banking interactions when it comes to complex transactions. In fact, 87% of both millennials and Gen Z rely on these face-to-face transactions to address their more dynamic banking needs.

Clearly, bank branches are not going away anytime soon. It is time to dig in deep and do the necessary legwork to make sure you are educated about where you stand relative to your competitive set. The banks that can best optimize their networks for profit and performance improvement, modernization, and “show rooming” will outlast the competition. When all is said and done, you’ll know the exact direction you need to take to drive your branch to success now, and for years to come.

James G. Caliendo is a former bank executive and now President and CEO at the 112 year old design-build and retail services firm. In the past 20 years alone, under Jim’s direction, PWCampbell has worked with over 500 financial institutions influencing millions of square feet of retail and operational space to create engaging, impactful and scalable solutions for every sized facility project.