From Teller to Touchpoint:

Redefining Consumer Engagement In The Branch

The financial industry has been experiencing a significant transformation in how consumers engage and move through branches.

This shift has given rise to a new consumer journey within bank branches, characterized by a seamless blend of digital convenience and personalized human interaction. With 72% of new account openings still happening in person, each branch visit is a valuable opportunity to create a strong first impression, build trust, and deliver personalized service. Making the most of the consumer journey in the branch can lead to deeper engagement, increased loyalty, and additional product opportunities. It’s a critical moment to demonstrate value, answer questions, and set the tone for a lasting banking relationship.

OMNICHANNEL BANKING

One of the defining elements of the new consumer journey is the growing emphasis on omnichannel banking—an integrated approach that ensures consistency and continuity across all consumer touchpoints. Today’s consumers no longer interact with their financial institution through a single channel; instead, they expect freedom to move fluidly between digital platforms and physical branches without friction. Whether starting a loan application on a mobile app, reviewing details on a desktop, or completing the process in-branch, consumers anticipate a seamless, unified experience.

This shift demands that financial institutions align their technology, data systems, and service models to support real-time information sharing and consistent service delivery

across all channels. It also calls for a reimagining of the physical branch as a connected point within the broader digital ecosystem—not a standalone location, but part of a holistic, consumer-centric journey.

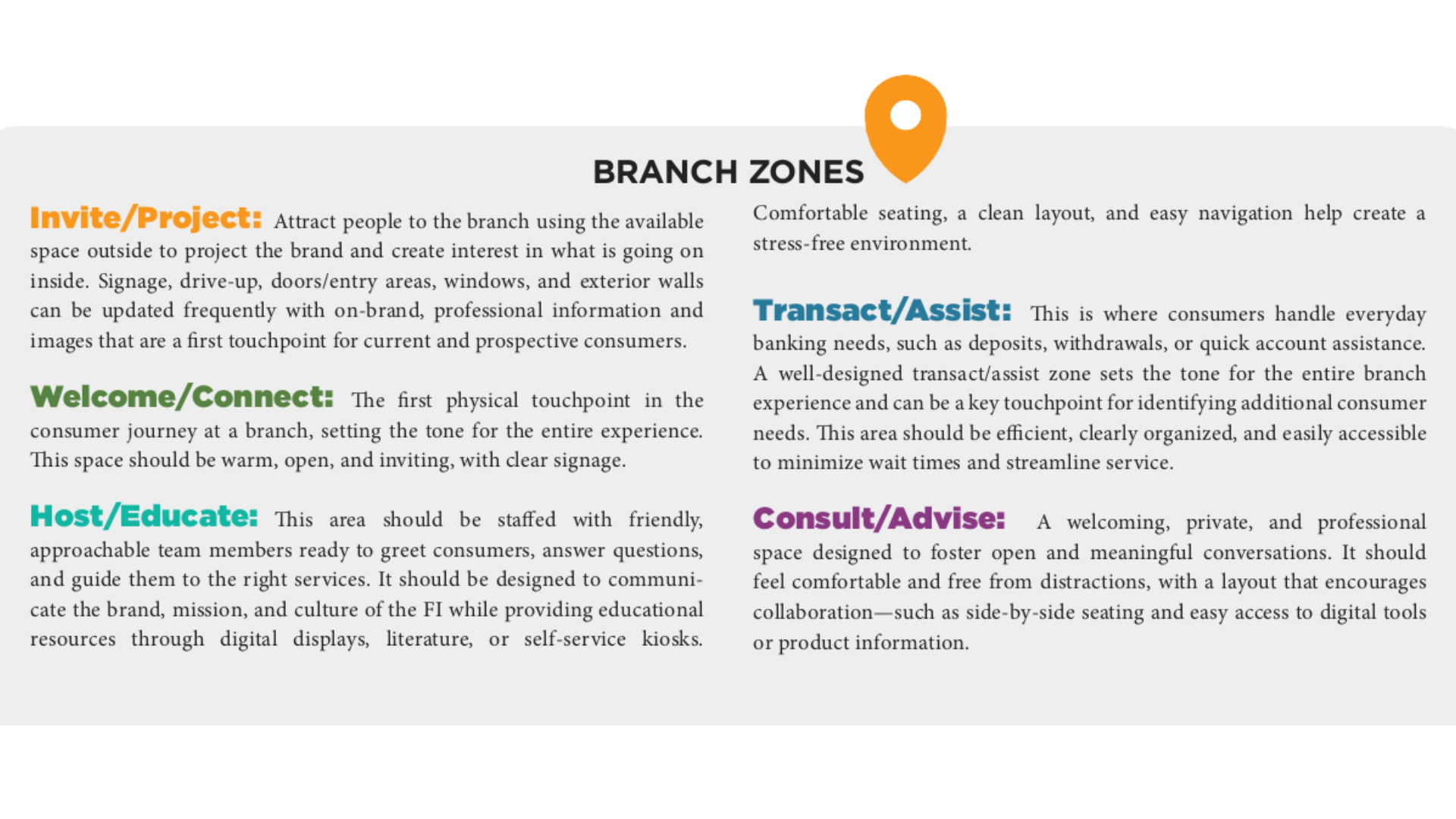

PHYSICAL LAYOUT

Modern bank branch zones must evolve to meet changing consumer preferences and technological advancements. Traditional teller lines can be replaced with pods or updated

to create more consumer-centric spaces that permit better service and efficiency. By offering secure transaction spaces and giving staff the ability to move to the consumer side for private consultation or to provide side-by-side educational or product information, the transaction area becomes a multi-purpose space focused on the consumer’s needs.

These modern branch zones also need to incorporate digital kiosks, self-service options, and areas for consultations with financial advisors. Additionally, there is a growing emphasis

on creating flexible layouts that can easily accommodate community events and educational seminars, fostering a sense of community engagement within the branch.

DATA ANALYTICS

Personalization is another key component of the new consumer journey in bank branches. Financial institutions can leverage data analytics and consumer insights to tailor their services and offerings to individual preferences and needs. By understanding consumer behavior and preferences, financial institutions can provide targeted recommendations, personalized advice, and customized solutions that enhance the overall consumer

experience. This level of personalization can also impact the branch layout and location, ensuring that the physical space is optimized to meet the specific needs and preferences

of your consumers.

EMPLOYEE ROLES

Furthermore, the role of employees is evolving to focus more on relationship-building and advisory services. Instead of simply processing transactions, branch staff can be cross trained to provide personalized financial education, address consumer inquiries, and offer tailored solutions to meet individual financial goals. This human touch complements the digital aspects of the consumer journey, creating a holistic and engaging banking experience. To support this shift, branches must feature flexible, multi-functional spaces

that support meaningful, consultative engagements. By prioritizing relationship-driven design over traditional transaction-focused layouts, financial institutions will build trust,

strengthen consumer loyalty, and deliver a seamless, integrated service experience.

CONCLUSION

As the financial landscape continues to evolve, so too must the way financial institutions engage with consumers. The new consumer journey is no longer defined solely by in-

person transactions, but by a dynamic blend of digital innovation and human-centered service. Through omnichannel strategies, adaptive branch layouts, and data-driven person-

alization, banks are redefining the role of the physical branch—from a place of routine transactions to a hub for meaningful interactions and financial empowerment. By embracing these changes, financial institutions can not only meet the expectations of today’s digitally-savvy consumers but also build lasting relationships and loyalty in an increasingly competitive market.

As the Chief Strategy Officer of PWCampbell, Kevin Poirot is a visionary leader who drives the organization forward with a strategic focus on elevating brand presence and leveraging cutting edge technology. Kevin has a keen understanding of market trends and

consumer behavior and works with the senior management team to formulate innovative strategies that equip PWCampbell to adapt to the evolving needs of our clients and company.